Certain industries need special consideration when processing payments and inventory management. One of those industries is the firearms industry, with its high regulatory overlay. These regulations can complicate the B2C interaction and necessitate additional software integrations. This is where the ECS and Trident1 partnership comes into play for the most comprehensive firearms payment processing.

Trident1 provides gun shop owners with POS software to run transactions (that is, the point of sale dashboard). ECS Payments is the firearm payment processor. To explain the distinction, ECS is responsible for the backend processes of completing payments. Trident1 provides the dashboard facing the employee.

Trident1 is the perfect dashboard for firearm payment processing because it integrates collecting payments with many other things like inventory and asset management and compliance measures.

The Trident1 corporate leadership (and founding team) comprises retired Navy SEALS who have direct experience with firearms– making the Trident1 software perfect for FFL vendors. It anticipates all the B2C interactions and challenges they’ll face.

But before we dive into the features of the ECS-Trident1 partnership, let’s talk about yet another reason why ECS is specifically a great FFL merchant account and merchant services provider. One of the main reasons is that gun-friendly credit card processing is hard to find.

High-Risk Firearms Payment Processing

The firearms industry is lumped into a group of industries labeled as high-risk by banks and card networks. There are several reasons these businesses are high-risk.

It has less to do with any moral judgment of the business and more with legal risks and the business’s potential to attract crime (either white-collar crime like money laundering or violent crime). Gambling, gun sales, adult entertainment, credit repair, cannabis, and supplements are some examples of high-risk businesses.

The Legal Landscape

Unfortunately, for better or worse, gun sales meet a few of these requirements. First off, there is the legal landscape around gun ownership. Once again, it is not as much a debate over 2A as it is the fact that every state has different laws about gun ownership.

Payment processors, card networks, and banks do not like working with business types where the underlying product or service creates complications when traveling across state lines (other examples include online gambling and cannabis).

Criminal Concern

Another issue is crime. The vast majority of gun owners are law-abiding, and a whopping 93% of violent crimes are committed with stolen firearms. Even so, guns are inextricably wrapped up in crime. “Those who live by the sword, die by the sword,” one might say, as 71% of gunshot victims had previous arrest records.

Close to 400 million firearms in America are used for hunting, shooting practice, and self-defense. Nonetheless, some are used to commit crimes. The criminal use of firearms makes financial institutions hesitate to deal with FFL retailers, as guns are a product that can create legal snares (another example is adult entertainment). Unfortunately, there are bad actor gun stores that do sell firearms illegally, such as 6 gun shops that flooded the streets of Philadelphia with 11,000 “crime guns.”

Gun stores can also sometimes become venues for white-collar crime. Of course, this can be weaponized beyond the point of reason, such as done with Operation Choke Point. However, there are instances of gun shop owners involved in money laundering. Guns and violent crime may sometimes be a “front end” to a “back end” of white-collar crime, as seen in organized crime networks.

Firearm Payment Processing Vs. Crime

For all these reasons, card networks and banks are, therefore, more hesitant to work with organizations that are involved with firearms. Whether or not these crime-related considerations are more relevant to FFL retailers than other types of businesses is a matter of much debate and possibly some numbers-fudging.

For instance, a study conducted by Scientific American suggested that gun store footprints are associated with increases in crime without examining possible other causes, such as the absence of mental health services or increased drug usage in the area.

Certainly, Operation Choke Point showed us that the Federal Government can and will weaponize ideological penchants to pressure financial institutions to view certain businesses as “risks.”

Gun store owners will have to face the fact that they are a “high risk” to most payment processors. Companies like Square, Stripe, and PayPal may not work with gun retailers. Additionally, there is a trend of particular ideological bent invading the tech space, and some of these startups may be averse to taking on FFL clients.

No problem for ECS payments. ECS is familiar with the “high-risk” merchant services businesses and their needs. They can work directly with their customers and create customized rate and fee schedules that benefit the business instead of leveraging punitive, one-sided contracts against business owners.

So, let’s look now at everything the ECS-Trident1 partnership can offer.

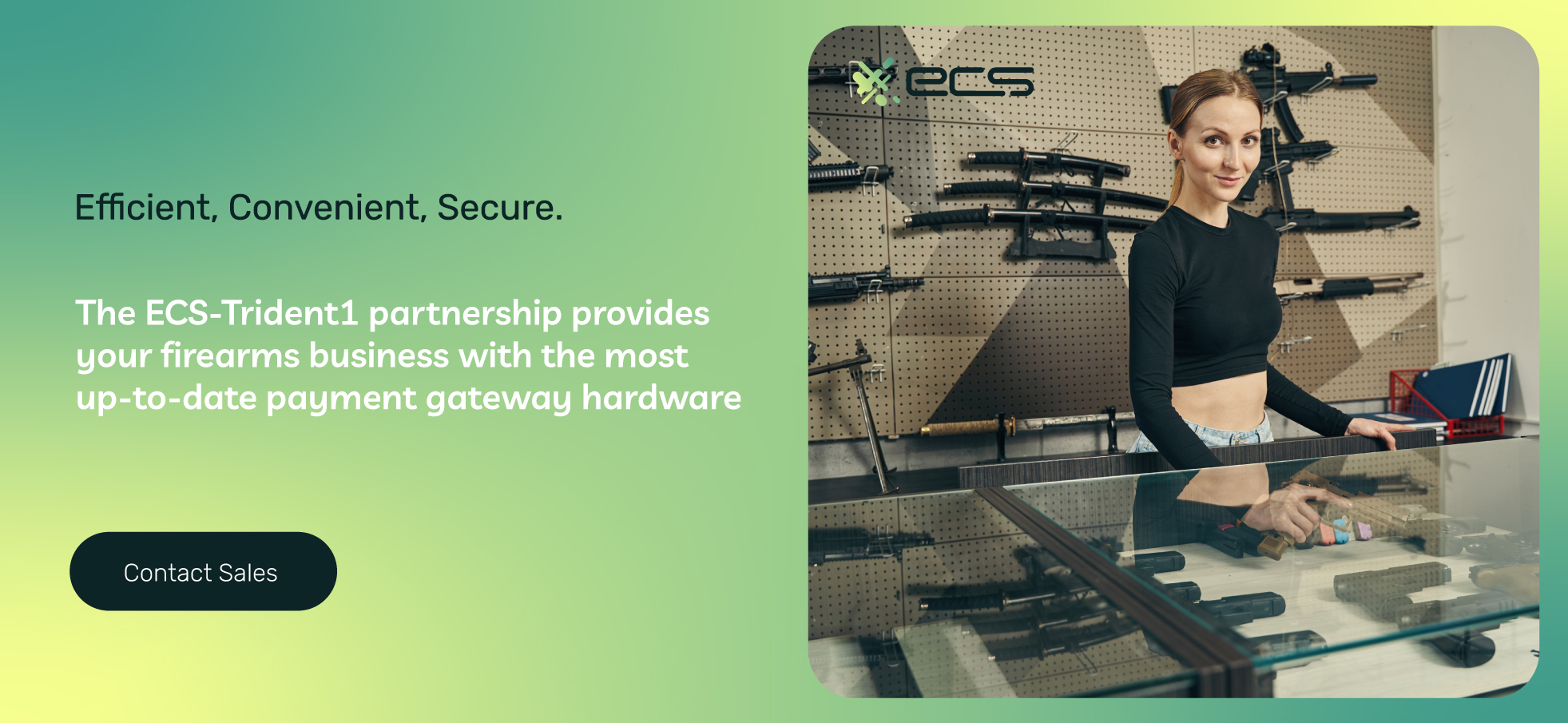

Firearm Payment Processing POS Hardware

The in-person point of sale requires a credit card processor. Today’s most secure forms of credit card processing are contactless payments and EMV chip payments. These contrast traditional magnetic stripe swipes, which are a very insecure payment processing solution.

The reason is that magnetic strips contain statically stored payment information like card number, cardholder name, expiration date, and security code. Static (non-changing) data facilitates the completion of the payment, but its ever-changing nature also makes it easier to steal with a card skimmer.

Card skimmers are small devices that can be implanted inside a POS. The devices collect data from every card swiped, which is sent wirelessly to nearby criminals. These criminals can use the card data to manufacture fake cards, make purchases online, or sell the data on the dark web.

It is not so with contactless payments or EMV chip insertions. These methods generate one-time, randomized encryptions to transfer underlying payment data. The data, in turn, must be decoded by the card networks and banks that facilitate the payment. Card skimming becomes irrelevant because each transaction has its own unique signature that cannot be replicated.

The ECS-Trident1 partnership provides your firearms business with the most up-to-date payment gateway hardware. While up-to-date tools are important in every industry, it’s especially important for gun dealers selling firearms.

That’s because firearms merchants may occasionally interact with customers using stolen credit cards to purchase firearms. While credit card fraud is problematic in any business, the consequences of gun sales can be higher.

Having the most up-to-date hardware for merchant services cuts down on fraud. Identifying suspicious and/or possibly fraudulent transactions in real-time becomes easier. Therefore, gun-friendly credit card processors like ECS can protect firearms merchants from participating in fraudulent purchases.

Firearm Memberships and Subscriptions

Firearms merchants and gunsmiths can also benefit from subscription services. Subscriptions could cover things like routine cleaning, for instance. While many gun enthusiasts may enjoy cleaning their firearms, not all do.

Some gun owners would be willing to pay for someone else to clean stored firearms the 1-2 times per year they need it. Of course, firearms used more frequently (for hunting or recreational shooting range visits) will need more frequent cleaning.

Then, there are also periodic gun repairs. Of course, customers can pay for these as they come up. However, some gun owners would be more than willing to pay for service plans covering a certain scope of repairs.

While some gun owners can repair their own firearms, many are not. Repairs done wrong can increase the damage and make the firearms dangerous to discharge or handle.

Gun store owners and/or gunsmiths can create subscriptions and memberships to offer at the point of sale. These service plans can increase revenue and keep customers engaged with your business long-term.

Memberships can also include built-in incentives to sign up. For instance, a membership can give customers discounts on future gun purchases, ammo, or one-off services.

Firearm Payment Processing and PCI Compliance

Creating these types of memberships and subscriptions requires storing customer credit and debit card information or bank account numbers. Storing sensitive data is not something most small businesses can do on their own while staying PCI compliant.

Payment Card Industry Data Security Standards (PCI DSS) are standards set forth by Visa and Mastercard about collecting and retaining customer financial data.

Some of these rules are reasonably easy to enforce, such as locking the POS system with a password and not using public wifi. But others, such as building and routinely testing firewalls, are cost-prohibitive for most SMBs. PCI compliance for these types of businesses is best achieved by outsourcing the storage of customer payment data to their payment processor.

Once again, that is where ECS comes into play. ECS can provide gun shops with the ability to offer memberships and subscriptions at the point of sale. You can collect and save customer payment data (with their approval) for monthly or annual charges. You won’t have to worry about storing any payment data yourself, as ECS will do that for you.

To sweeten the pot, the ECS-Trident1 partnership can facilitate push notifications to members and subscribers, reminding them about upcoming payments. Push notifications also remind them when it is time to bring a gun in for a cleaning or routine service. Reminders can significantly improve the customer experience and create readily evident value to the subscription or membership.

Merchant Cash Advance

One of the ancillary business services offered by ECS is merchant cash advance. A merchant cash advance is a different type of loan because it is based on cash flow more than credit history. ECS can offer merchant cash advances to companies that accept debit and credit card payments. The merchant can repay the loan by taking a fixed or percentage portion of the sales revenue.

Merchant cash advances can be approved much faster than other types of loans. As such, a merchant cash advance can help your FFL business when it needs cash suddenly. Examples include:

- Purchasing new inventory that suddenly comes around.

- Paying taxes.

- A surprise fine or fee (which, obviously, you do not want to happen).

A merchant cash advance for these surprises can keep your cash reserves full.

A merchant cash advance can also stabilize your operating expenses during a downturn in sales. While 2020 was a record hot year in firearm sales, with 21.8 million sold, sales cooled slightly to 18.9 million in 2021 and 16.6 million—a nearly 24 % decrease, which is incredibly significant.

Thankfully, gun sales are somewhat cyclic, and the industry will bounce back. However, individual retailers are certainly impacted. These retailers can float through dry spells without tapping into their reserves by using a merchant cash advance.

Online Payment Gateways For Firearm Payment Processing

Online FFL payments could include a variety of goods and services. All of these must be purchased through a secure payment gateway. Similar to card skimming devices installed in payment processing hardware, online card skimmers can collect numbers and other card information from customers. For instance, over 90,000 customers shopping with Rainier Arms and Numrich Gun Parts were impacted by an ongoing data breach from 2021-2022.

Online FFL payment processing will need the most secure firewalls and encryption to operate safely. Card networks, banks, and payment processors also use machine learning or AI to analyze cardholder spending patterns. Purchases that fall outside the scope of normal (by location, size of purchase, or the MCC of the merchant) may be stopped until further verification is completed.

An online firearm merchant account serviced by ECS can provide these safety measures. In most states, customers cannot simply order a gun online and have it delivered to their homes. The firearm must be transferred from one licensed FFL dealer to another, especially if it is crossing state lines.

FFL merchant services for online payments must factor this logistical concern into the sale. In some cases, the customer will need to reach out to a local FFL dealer and coordinate a pickup after a background check.

However, it is also possible for the retailer who has sold the firearm to spearhead the coordination of this process by contacting the customer and discussing where to send the purchase.

Proper communication can improve the customer experience. In any case, regulatory requirements must be observed, along with safety measures against fraudulent payments. FFL-friendly payment processing for online must factor both these concerns in.

Firearms Are an Investment

For some customers, guns are an investment. Rifles are popular choices for home defense and hunting. Gun enthusiasts can expect to pay $500 to $1,000 (or more) on average for a rifle. Handguns (particularly semi-automatics and revolvers) are popular for home defense and recreational shooting. One can expect to pay $400 to $800 (or more) for a handgun.

Either way, firearms can be a significant expense for financially strapped consumers. Nearly half of American consumers do not even have $500 in savings to cover an emergency expense. And while it’s true that some of them can rely on credit cards, some cannot.

Even those who can turn to credit cards have used them for everyday purchases in light of inflation. Using credit on everyday purchases leaves cardholders with less available credit for larger purchases.

Buy Now Pay Later (BNPL)For Firearm Payment Processing

This is where BNPL or buy now pay later can come into play. BNPL is a financing arrangement where customers can break their purchases into installments. You might be hesitant to enter into such an arrangement.

However, there is no concern about collecting your payment because that is facilitated by the payment processor or the fintech company integrated into the payment.

Here’s how it works: The customer is given the option to use a payment plan at the time of purchase. Unlike credit cards, these payment plans typically have 0% interest. However, the BNPL provider charges the merchant a fee.

Within 24-48 hours (usually), the merchant receives their payment in full, and the customer is responsible for making payments to the BNPL company or the payment processor.

You may have seen this trend in retail, in your own shopping. Companies like Klarna, Affirm, and Afterpay have partnered with several retailers like Amazon and Target to offer customers payment plans. For a large purchase like a rifle, shotgun, or handgun, this type of payment plan, or the absence thereof, can make or break a decision to purchase.

Consumers Love BNPL

In 2022, 360 million consumers worldwide used BNPL, and it’s estimated that by 2027, BNPL spending will reach $437 million (a 290% increase from 2022). Around 50% of American consumers are interested in BNPL, and 10% already regularly use BNPL at checkout. This upward trend indicates that BNPL may be a longstanding competitor to traditional credit card purchases.

ECS payments can facilitate this type of FFL payment solution. With BNPL options, you may easily turn browsing gun enthusiasts into customers. Some studies have shown that BNPL increases conversion rates by 20% or even 30%.

Shooting Range Management

Shooting ranges are popular locations for practicing marksmanship and getting familiar with firearm handling. Hunters can use a shooting range to improve their skills during the off-season. And homeowners (or renters, even) can go to the shooting range to feel more secure about handling a gun if they ever need to defend their life or property.

There are 18,000 estimated indoor ranges around the United States. The number of ranges varies widely from state to state. For example, there are 144 shooting ranges in Florida but only 9 in Hawaii. While certain states and cities have strict gun control laws, most of the country has one shooting range for every 100,000 residents.

This number shows you the popularity of shooting ranges. Although they are great places to practice marksmanship towards other ends (hunting or self-defense), they are also recreational activities in their own right. Around 52% of gun-owning adults regularly go to a shooting range, another 30% go rarely, and the other 18% really should at least sometimes.

The ECS-Trident1 partnership is also great for shooting ranges. ECS can provide the gun store payment solutions on the backend, while Trident1 can provide the POS software, asset management, and compliance support. This way, everything is accessible from a singular dashboard, and employees do not have to bounce back and forth between different systems.

All-in-One Dashboard

Employees can manage every function of the range from the Trident1 dashboard. Schedule lane rentals, see which lanes are vacant, and create customized experiences. For example, you can create late-hours shooting arrangements, group deals, and membership deals.

Another great thing about Trident1 is that you can streamline your operational requirements with notifications. Indoor and outdoor ranges have different needs, but either way, the Trident1 dashboard can help you with maintenance.

You can keep track of gun and lane usage and schedule repairs and maintenance accordingly. These proactive maintenance parameters can also increase the safety factor of your range by decreasing accidents.

Public and private shooting range events like fundraisers, charity nights, and parties are also easy to schedule. You can assign employees, reserve firearms and ammo, and take note of unique customer requests. Events will sync with internal and website calendars to avoid double booking.

With shooting ranges, subscriptions and memberships come back into the picture. Shooting range memberships can encourage more active participation among your customer base. If your range also has a gun store, the shooting range experiences can funnel into gun sales.

Shooting range customers who have never owned a gun can get more comfortable handling them. Current gun owners will be more likely to turn to you to purchase new or additional firearms, especially if memberships include discounts.

Once again, the ECS-Trident1 partnership is key. Trident1 is the dashboard that animates the B2C interaction, but the payment processor behind the scenes is ECS. ECS can help you save customer payment information according to PCI DSS standards to bill your members periodically, whether monthly or annually.

Regulatory Compliance For Firearms

In many states, gun-purchasing customers must undergo a universal background check. And everyone everywhere must fill out an ATF 4473. Trident1’s partnership with FastBound makes it easy for your customer to complete this form electronically. You will not have to bounce back and forth between multiple systems or collect and retain (actual) paper paperwork.

FastBound can also perform Federal NCIS and multistate background checks. Background checks can all be accessed from the point of sale through the Trident1 platform. NCIS background checks recently reached record levels, with 38.9 million performed in 2021.

Some states, however, require their own background checks and compliance measures. These measures can be integrated into the Trident1 platform to streamline sales.

Many gun store owners slapped with ATF fines attributed them to clerical errors, such as moving data from one system to another or from paper to electronic submission. With Trident1, customers can receive the ATF form on a tablet, computer, or even their smartphone.

With the Trident1-ECS partnership, everything is done in one place, including compliance-related entries. Gunsmiths can take advantage of an ATF-compliant A&D book for overnight repairs. For trade shows, cloud software allows reps to update the A&D book from any location. Importers, pawnshops, and ammunition dealers can also meet regulatory standards with extra layers of compliance for NFA 2, 3, 6, and 8 FFL types.

Another benefit to the Trident1 system in terms of compliance is the backing by FFLGuard. Since 2007, FFLGuard has provided firearm compliance legal support to several partners, including Brinks, Heckler & Koch, Gearfire, and Epicor. Given today’s hostile legislative environment around gun ownership (stirred up further by consumer-facing media), legal support is indispensable.

ECS-Trident1 Firearm Payment Processing Wrap-Up

ECS and Trident1 form an incredible partnership for the FFL industry. The corporate leadership of Trident1 is particularly relevant. Their Navy SEALS experience makes them familiar with the end product: firearms.

With their other experiences in financial services and business management, they are familiar with the ins and outs of running a business and firearm payment processing. Trident1 brings all these experiences together in their dashboard.

Then, behind the scenes, there is ECS payments. ECS has experience in working with high-risk merchants such as FFL retailers. They provide the latest and most secure hardware and software to process payments, store payment information, and maintain PCI DSS compliance.

For more information on how this partnership can benefit your gun shop, shooting range, or other FFL retailer, call or contact us using the form below.